Why is the Pound Falling? Understanding the Factors Behind the GBP’s Weakness

The British pound (GBP), often referred to as the pound sterling, has experienced significant volatility and, at times, considerable weakness in recent years. Understanding why the pound is falling requires a nuanced examination of various economic, political, and global factors. This article delves into the key reasons behind the GBP’s struggles, providing a comprehensive overview for those seeking to understand the dynamics affecting the UK currency.

Economic Fundamentals Weakening the Pound

One of the primary drivers behind why the pound is falling is the state of the UK economy. Several economic indicators contribute to the pound’s performance, and persistent weakness in these areas can exert downward pressure.

Inflation and Interest Rates

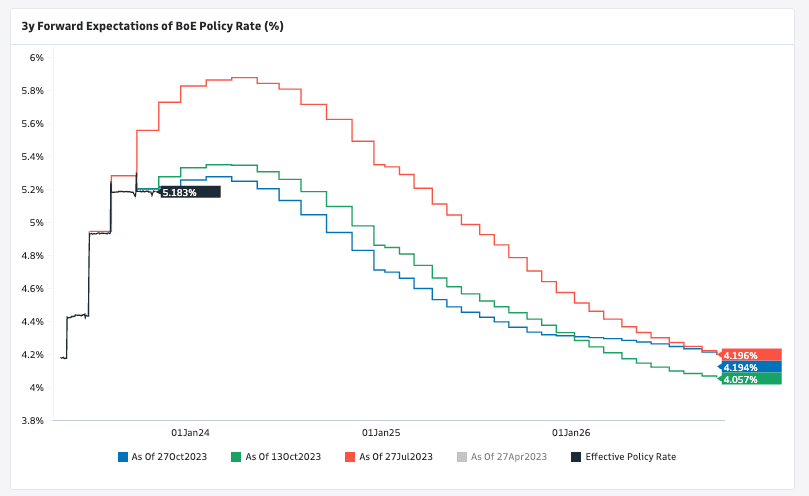

Inflation plays a critical role. When inflation rises faster than anticipated, it erodes the purchasing power of the currency. The Bank of England (BoE) attempts to control inflation through interest rate adjustments. If the BoE is perceived as being too slow or ineffective in raising interest rates to combat inflation, investors may lose confidence in the pound, leading to its depreciation. Conversely, excessively high interest rates can also harm the economy by stifling growth, which can also negatively impact the pound. [See also: UK Economic Outlook]

Economic Growth and Recession Fears

Slowing economic growth or, worse, the prospect of a recession, significantly impacts the pound. A contraction in the UK’s GDP signals weaker economic activity, which makes the UK a less attractive destination for investment. Investors tend to move their capital to economies with stronger growth prospects, leading to a sell-off of the pound. The uncertainty surrounding economic forecasts, particularly in the wake of global economic shocks, further exacerbates this trend. If economic data consistently underperforms expectations, the pressure on why the pound is falling intensifies.

Trade Deficit

A persistent trade deficit, where a country imports more goods and services than it exports, can also contribute to a weaker currency. The UK has historically run a trade deficit, which means there is a continuous outflow of pounds to pay for these imports. This increased supply of pounds in the global market can devalue the currency, especially if exports do not adequately offset the imports. Changes in global trade dynamics and the UK’s competitiveness in international markets play a significant role here. [See also: Impact of Trade on the Pound]

Political Uncertainty and its Impact on the Pound

Political events and policy decisions can have a profound impact on currency values. The UK has experienced considerable political upheaval in recent years, each contributing to the volatility and decline of the pound.

Brexit and its Lingering Effects

The decision to leave the European Union (Brexit) has been a major factor in why the pound is falling since the 2016 referendum. The uncertainty surrounding the UK’s future trading relationship with the EU, its largest trading partner, has weighed heavily on investor sentiment. The actual implementation of Brexit, including the complexities of new trade agreements and regulatory frameworks, has continued to create economic uncertainty. Ongoing debates about the Northern Ireland Protocol and its impact on trade relations further contribute to the pound’s weakness.

Government Policy and Stability

Changes in government and shifts in economic policy can also impact the pound. Political instability, such as frequent changes in leadership or major policy U-turns, can erode investor confidence. Fiscal policies, including government spending and taxation plans, also play a role. If government policies are perceived as unsustainable or detrimental to economic growth, investors may react negatively, leading to a decline in the pound. The credibility of the government’s economic management is crucial for maintaining confidence in the currency.

Global Factors Influencing the Pound

The pound’s performance is not solely determined by domestic factors. Global economic conditions and geopolitical events also play a significant role.

Global Economic Slowdown

A global economic slowdown can impact the pound in several ways. Reduced global demand can decrease demand for UK exports, exacerbating the trade deficit. Furthermore, during times of global economic uncertainty, investors often seek safe-haven assets, such as the US dollar or the Japanese yen, leading to a sell-off of riskier currencies like the pound. The interconnectedness of the global economy means that events in other countries can have ripple effects on the UK and its currency.

Geopolitical Risks

Geopolitical risks, such as international conflicts, trade wars, or political instability in other regions, can also affect the pound. Heightened global uncertainty often leads to increased risk aversion among investors, who may move their capital to safer assets. Events such as the war in Ukraine have had a significant impact on global energy prices and supply chains, further contributing to economic uncertainty and impacting the pound. [See also: Geopolitical Risks and Currency Markets]

Strength of Other Currencies

The pound’s value is also relative to other currencies. If other major currencies, such as the US dollar or the euro, are strengthening, the pound may appear to be falling even if its own fundamentals are relatively stable. For example, if the US Federal Reserve is aggressively raising interest rates while the Bank of England is more cautious, the dollar may strengthen relative to the pound. The relative strength of different economies and their respective monetary policies play a crucial role in determining currency valuations.

The Impact of Quantitative Easing (QE)

Quantitative easing (QE), a monetary policy tool used by central banks to stimulate economic growth, can also influence the value of the pound. QE involves a central bank purchasing government bonds or other assets to inject liquidity into the financial system. While QE can help lower borrowing costs and stimulate economic activity, it can also lead to inflation and currency devaluation. If the Bank of England engages in QE on a large scale, it can increase the supply of pounds in the market, potentially leading to a decline in its value. The effectiveness and impact of QE are often debated, and its effects on the pound can be complex and multifaceted.

Market Sentiment and Speculation

Market sentiment and speculation can also play a role in why the pound is falling. Currency markets are highly liquid and can be influenced by investor expectations and trading behavior. If investors believe that the pound is likely to weaken, they may sell it, leading to a self-fulfilling prophecy. Speculative trading, where investors attempt to profit from short-term price movements, can also amplify the volatility of the pound. News headlines, economic data releases, and statements from policymakers can all influence market sentiment and drive currency fluctuations. Understanding the psychology of the market and the factors that influence investor behavior is essential for comprehending currency movements.

Conclusion: Navigating the Complexities of the Pound’s Value

Understanding why the pound is falling requires a comprehensive analysis of economic fundamentals, political developments, and global factors. Inflation, economic growth, trade deficits, Brexit, government policy, global economic conditions, geopolitical risks, and market sentiment all contribute to the pound’s performance. Monitoring these factors and understanding their interplay is essential for anyone seeking to navigate the complexities of the currency market and make informed decisions. The future value of the pound will depend on how these various forces evolve and how the UK economy responds to the challenges and opportunities it faces. The factors influencing why the pound is falling are constantly shifting, requiring continuous analysis and adaptation to understand the dynamics at play.