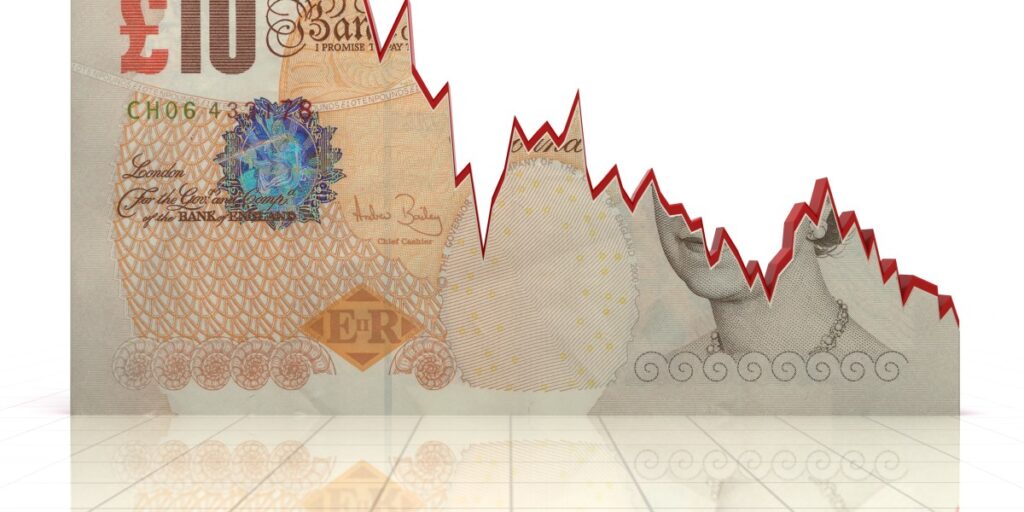

Why is the UK Pound Falling? Understanding the GBP’s Recent Weakness

The British pound (GBP), also known as the UK pound, has experienced significant volatility and a general downward trend in recent times. Understanding why the UK pound is falling requires a multifaceted analysis, considering economic indicators, political factors, and global events. This article delves into the key reasons behind the pound’s weakness, providing a clear and concise explanation for both seasoned investors and those new to financial markets. The recent performance of the UK pound has raised concerns, leading to questions about the UK’s economic stability and future prospects. So, why is the UK pound falling, and what are the implications?

Economic Factors Contributing to the Pound’s Decline

Inflation and Cost of Living Crisis

One of the primary drivers behind the falling UK pound is persistent high inflation. The UK has been grappling with a cost-of-living crisis, with inflation rates soaring to levels not seen in decades. This erodes the purchasing power of the pound, making goods and services more expensive for consumers. When inflation is high, the central bank, the Bank of England (BoE), typically responds by raising interest rates to curb spending and cool down the economy. However, the pace and extent of these rate hikes have been insufficient to offset the negative sentiment surrounding the UK economy. The perception that the BoE is behind the curve in tackling inflation contributes to the pound’s weakness. The ongoing struggle with inflation is a key factor in why the UK pound is falling.

Recession Fears

Concerns about a potential recession in the UK are also weighing heavily on the pound. Economic indicators have pointed towards a slowdown in growth, with some analysts predicting a contraction in the UK economy. Factors contributing to these recession fears include rising energy prices, supply chain disruptions, and the impact of Brexit on trade. A recession would typically lead to lower interest rates, further weakening the pound. The anticipation of a recession is a significant reason why the UK pound is falling, as investors become risk-averse and seek safer havens for their capital.

Current Account Deficit

The UK has a persistent current account deficit, meaning it imports more goods and services than it exports. This deficit needs to be financed by inflows of capital from abroad. When investor confidence in the UK economy wanes, these capital inflows can dry up, putting downward pressure on the pound. A large current account deficit makes the UK more vulnerable to external shocks and increases the sensitivity of the pound to global economic conditions. This imbalance is another piece of the puzzle explaining why the UK pound is falling.

Political and Geopolitical Influences

Brexit Uncertainty

The long-term economic consequences of Brexit continue to cast a shadow over the UK economy and the pound. While the UK has officially left the European Union, the full impact of Brexit on trade, investment, and labor markets is still unfolding. Uncertainty surrounding the future relationship between the UK and the EU weighs on investor sentiment and contributes to the pound’s volatility. The ongoing adjustments and negotiations related to Brexit are undoubtedly a factor in why the UK pound is falling.

Political Instability

Political instability within the UK government can also undermine confidence in the pound. Frequent changes in leadership, policy U-turns, and internal divisions can create uncertainty and deter investment. A stable and predictable political environment is crucial for attracting foreign capital and supporting the pound. Recent periods of political turmoil have exacerbated the downward pressure on the currency, adding another layer to the question of why the UK pound is falling.

Global Geopolitical Risks

Global geopolitical risks, such as the war in Ukraine, can also impact the pound. These events can lead to increased risk aversion and a flight to safety, with investors seeking refuge in currencies like the US dollar or the Swiss franc. The UK economy is not immune to these global shocks, and the pound can suffer as a result. Global uncertainty contributes indirectly to why the UK pound is falling, as investors re-evaluate their risk exposure.

Monetary Policy and Interest Rates

Bank of England’s Response

The Bank of England’s monetary policy decisions play a crucial role in influencing the value of the pound. As mentioned earlier, the BoE has been raising interest rates to combat inflation. However, the effectiveness of these rate hikes in supporting the pound depends on several factors, including the pace of tightening, the credibility of the central bank, and the overall economic outlook. If the market perceives that the BoE is not doing enough to control inflation, or if the rate hikes are expected to trigger a recession, the pound may continue to weaken. Understanding the BoE’s actions is critical to understand why the UK pound is falling.

Interest Rate Differentials

Interest rate differentials between the UK and other major economies can also impact the pound. If interest rates in the UK are lower than those in other countries, investors may be more inclined to invest in those countries, putting downward pressure on the pound. The relative attractiveness of the UK as an investment destination is a key determinant of capital flows and the value of the currency. The comparison of interest rates explains partially why the UK pound is falling compared to other currencies.

Market Sentiment and Investor Confidence

Speculative Trading

Speculative trading in the foreign exchange market can amplify the movements of the pound. Traders who believe that the pound will continue to weaken may take short positions, further driving down its value. Market sentiment can be self-fulfilling, with negative news and forecasts reinforcing the downward trend. The role of speculative trading explains a short-term aspect of why the UK pound is falling.

Investor Confidence

Ultimately, the value of the pound depends on investor confidence in the UK economy. If investors believe that the UK is facing significant economic challenges, they may be less willing to hold the currency, leading to a decline in its value. Restoring investor confidence requires addressing the underlying economic and political issues that are weighing on the pound. Regaining investor trust is paramount to reversing the trend of why the UK pound is falling.

Conclusion: The Complex Factors Behind the Pound’s Weakness

In conclusion, why the UK pound is falling is a complex issue with no single, simple answer. It is influenced by a combination of economic factors, political developments, monetary policy decisions, and market sentiment. High inflation, recession fears, Brexit uncertainty, political instability, and global geopolitical risks all contribute to the pound’s weakness. Understanding these factors is crucial for investors and policymakers alike. Addressing the underlying economic and political challenges is essential for restoring confidence in the UK economy and supporting the pound. It’s a multifaceted issue, and monitoring these factors is key to understanding the future trajectory of the UK pound. To recap, several elements contribute to why the UK pound is falling, requiring a holistic approach to understanding its future performance.

[See also: UK Economic Outlook 2024] [See also: Impact of Brexit on the British Economy] [See also: Bank of England Monetary Policy]