Will IonQ Stock Go Up? A Comprehensive Analysis of IonQ’s Future Prospects

The question on many investors’ minds is: Will IonQ stock go up? IonQ (NYSE: IONQ) is a leader in the quantum computing space, a sector brimming with potential but also fraught with risk. Predicting the future of any stock, especially one in a nascent industry like quantum computing, requires a deep dive into various factors, including technological advancements, market trends, financial performance, and competitive landscape. This article provides a comprehensive analysis to help you assess whether IonQ stock is poised for growth.

Understanding IonQ and the Quantum Computing Landscape

IonQ stands out in the quantum computing arena due to its trapped-ion technology. Unlike some competitors using superconducting qubits, IonQ’s approach relies on manipulating individual ions with lasers. This method offers certain advantages in terms of qubit stability and connectivity, which are crucial for building more powerful and reliable quantum computers. The company’s focus has always been on enhancing quantum computing capabilities and making them accessible to a wide range of users.

The quantum computing market is still in its early stages, but analysts predict substantial growth in the coming years. This growth is driven by the potential of quantum computers to solve complex problems that are currently intractable for classical computers. Applications span various industries, including drug discovery, materials science, financial modeling, and artificial intelligence. Companies like IonQ are at the forefront of this technological revolution, aiming to unlock these transformative capabilities.

Factors Influencing IonQ Stock Performance

Technological Advancements

The core of IonQ‘s potential lies in its technological progress. The company consistently announces improvements in its quantum computers’ qubit count, coherence, and gate fidelity. These metrics are vital for achieving quantum advantage, the point at which quantum computers can outperform classical computers on specific tasks. If IonQ continues to demonstrate significant technological breakthroughs, investor confidence in IonQ stock will likely increase. Ongoing research and development are crucial for maintaining a competitive edge in this rapidly evolving field.

Market Adoption and Partnerships

Beyond technological prowess, the adoption of IonQ’s quantum computing services is a key indicator of its future success. Partnerships with businesses, research institutions, and government agencies demonstrate the real-world applicability of IonQ’s technology. Increased adoption translates to higher revenue and strengthens the company’s position in the market. Keep an eye on announcements of new partnerships and collaborations as they can significantly impact IonQ stock performance. [See also: Quantum Computing Partnerships]

Financial Performance and Projections

Analyzing IonQ’s financial statements is crucial for assessing its long-term viability. Revenue growth, gross margins, operating expenses, and cash flow are all important metrics to consider. While IonQ is currently investing heavily in research and development, investors will be looking for signs of increasing revenue and a clear path to profitability. Positive financial results and optimistic future projections can drive IonQ stock higher. However, any significant financial setbacks could negatively impact investor sentiment.

Competitive Landscape

The quantum computing market is becoming increasingly competitive, with companies like IBM, Google, and Rigetti also vying for market share. IonQ must differentiate itself through technological innovation, strategic partnerships, and effective marketing. Staying ahead of the competition is essential for maintaining its leadership position and attracting investors. A thorough understanding of the competitive landscape is necessary to assess the long-term prospects of IonQ stock. [See also: Quantum Computing Industry Analysis]

Investor Sentiment and Market Conditions

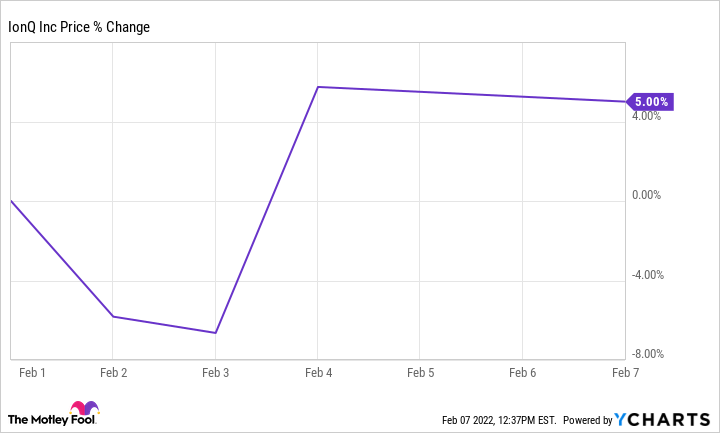

IonQ stock, like any other stock, is influenced by overall market sentiment and investor behavior. Factors such as interest rates, economic growth, and geopolitical events can impact investor appetite for risk, which in turn affects the valuation of growth stocks like IonQ. Keeping abreast of macroeconomic trends and market news is important for understanding the broader context in which IonQ stock operates. News sentiment and social media trends can also play a role in short-term price fluctuations.

Potential Risks and Challenges

Investing in IonQ, or any quantum computing company, comes with inherent risks. The technology is still in its early stages, and there is no guarantee that quantum computers will achieve their full potential. Technical challenges, such as improving qubit stability and scalability, could delay progress and impact IonQ stock. Furthermore, the high cost of research and development could strain the company’s financial resources. Regulatory uncertainties and ethical considerations surrounding quantum computing also pose potential challenges.

Expert Opinions and Analyst Ratings

Consulting with financial analysts and experts can provide valuable insights into the potential of IonQ stock. Analyst ratings, price targets, and investment recommendations can help investors make informed decisions. However, it’s important to remember that analyst opinions are not always accurate, and investors should conduct their own due diligence before investing. Look for consensus estimates and consider the rationale behind different analysts’ recommendations.

Long-Term Outlook for IonQ Stock

The long-term outlook for IonQ stock depends on a combination of factors, including technological advancements, market adoption, financial performance, and competitive landscape. If IonQ can continue to innovate and expand its market presence, the stock has the potential for significant growth. However, investors should be prepared for volatility and be aware of the inherent risks associated with investing in a nascent industry. A diversified investment portfolio and a long-term investment horizon are recommended for those considering investing in IonQ stock.

Conclusion: Will IonQ Stock Go Up? A Balanced Perspective

So, will IonQ stock go up? There’s no definitive answer. The future of IonQ stock hinges on the company’s ability to execute its vision, overcome technical challenges, and capitalize on the growing demand for quantum computing solutions. While the potential upside is significant, investors should carefully weigh the risks and conduct thorough research before making any investment decisions. Monitoring key performance indicators, staying informed about industry trends, and consulting with financial professionals are essential for navigating the complexities of investing in IonQ stock. The company’s success in developing groundbreaking quantum technology and securing strategic partnerships will be critical for driving long-term shareholder value. Ultimately, the decision of whether or not to invest in IonQ stock is a personal one that should be based on individual risk tolerance and investment goals. Keep a close eye on IonQ‘s progress and the overall quantum computing landscape to make informed decisions about IonQ stock. The future looks promising, but only time will tell if IonQ fulfills its potential. The trajectory of IonQ and its stock depends heavily on continued innovation and market acceptance. Investors should remain vigilant and adapt their strategies as the quantum computing industry evolves. Don’t forget to consider the broader economic factors that could impact IonQ and the overall market. The success of IonQ will not only benefit its investors but also contribute significantly to the advancement of technology as a whole. By carefully analyzing all available information, investors can make well-informed decisions regarding IonQ stock and its potential for future growth. The question of whether IonQ will continue its upward trajectory is one that requires ongoing monitoring and a deep understanding of the company’s strengths, weaknesses, opportunities, and threats. Remember to consult with a financial advisor before making any investment decisions related to IonQ or any other stock.