Will IonQ Stock Go Up? A Comprehensive Analysis of IonQ’s Potential

The question of whether IonQ stock will go up is on the minds of many investors interested in the burgeoning quantum computing market. IonQ (NYSE: IONQ) is a leading player in this innovative field, promising to revolutionize industries through its powerful quantum processors. However, like any emerging technology company, investing in IonQ involves a degree of risk and requires careful consideration of various factors. This article will delve into the current state of IonQ, analyze its potential for growth, and examine the factors that could influence its stock price.

Understanding IonQ and Quantum Computing

Before assessing whether IonQ stock will go up, it’s crucial to understand the company and its place within the quantum computing landscape. Quantum computing leverages the principles of quantum mechanics to solve complex problems that are intractable for classical computers. This technology has the potential to transform fields like drug discovery, materials science, finance, and artificial intelligence.

IonQ distinguishes itself through its trapped-ion technology. This approach uses individual ions (electrically charged atoms) to represent qubits, the fundamental units of quantum information. Trapped-ion technology offers advantages in terms of qubit coherence and fidelity, which are critical for building powerful and reliable quantum computers. IonQ claims its technology is superior to other approaches, like superconducting qubits, although both are actively being developed and improved. The core question remains: Will IonQ stock go up based on this technological advantage?

Factors Influencing IonQ’s Stock Price

Several factors can influence the price of IonQ stock. These can be broadly categorized into internal factors (related to the company itself) and external factors (related to the market and the broader economy).

Internal Factors

- Technological Advancements: IonQ’s ability to improve the performance and scalability of its quantum processors is paramount. Any breakthroughs in qubit count, coherence time, or gate fidelity could positively impact the stock price. Conversely, setbacks or delays in development could have a negative effect.

- Commercialization and Revenue Generation: IonQ needs to demonstrate its ability to translate its technology into revenue. This involves securing contracts with businesses, government agencies, and research institutions. The size and frequency of these contracts will be a key indicator of the company’s commercial success. The question of will IonQ stock go up is heavily tied to its ability to generate consistent revenue.

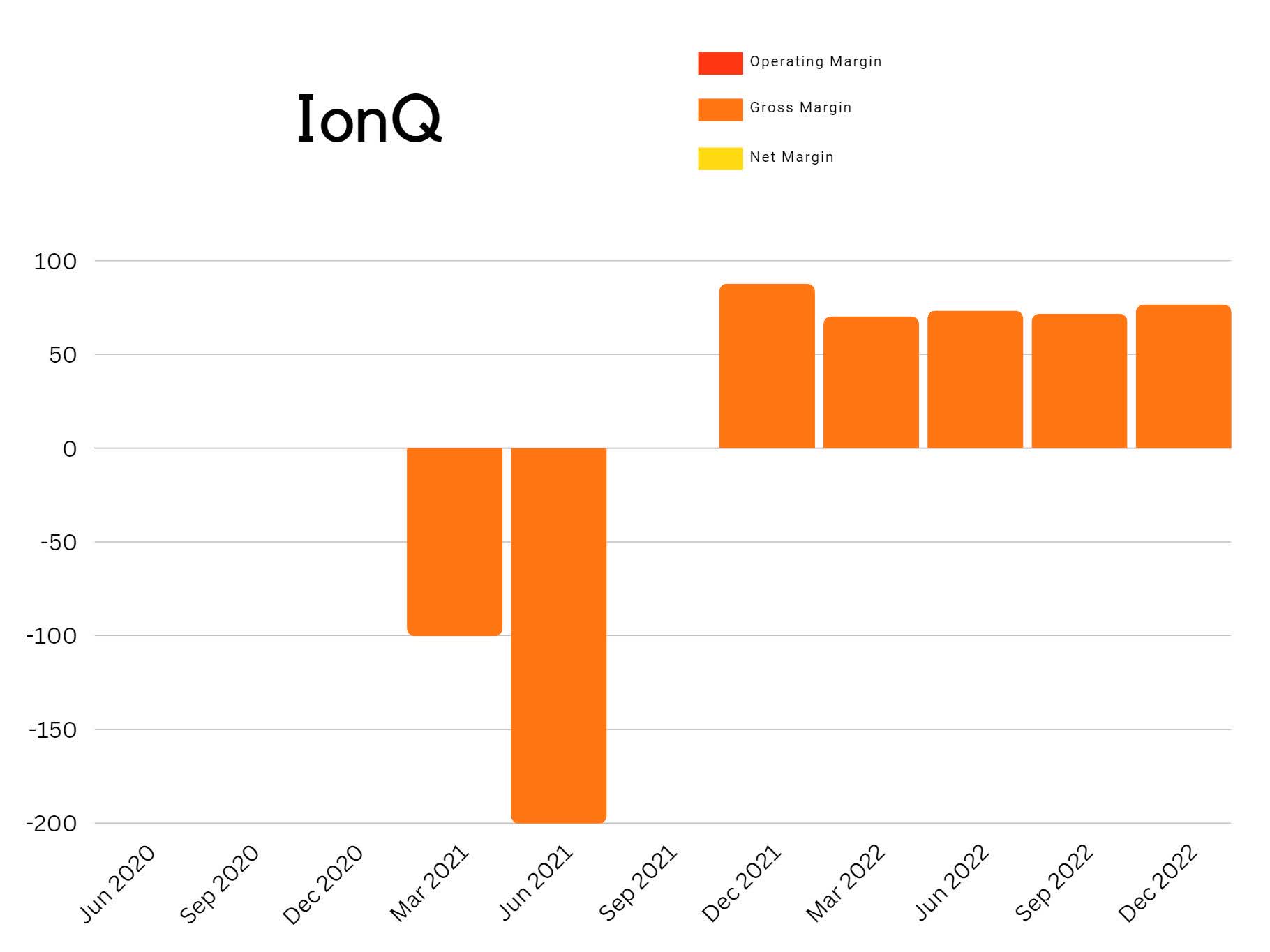

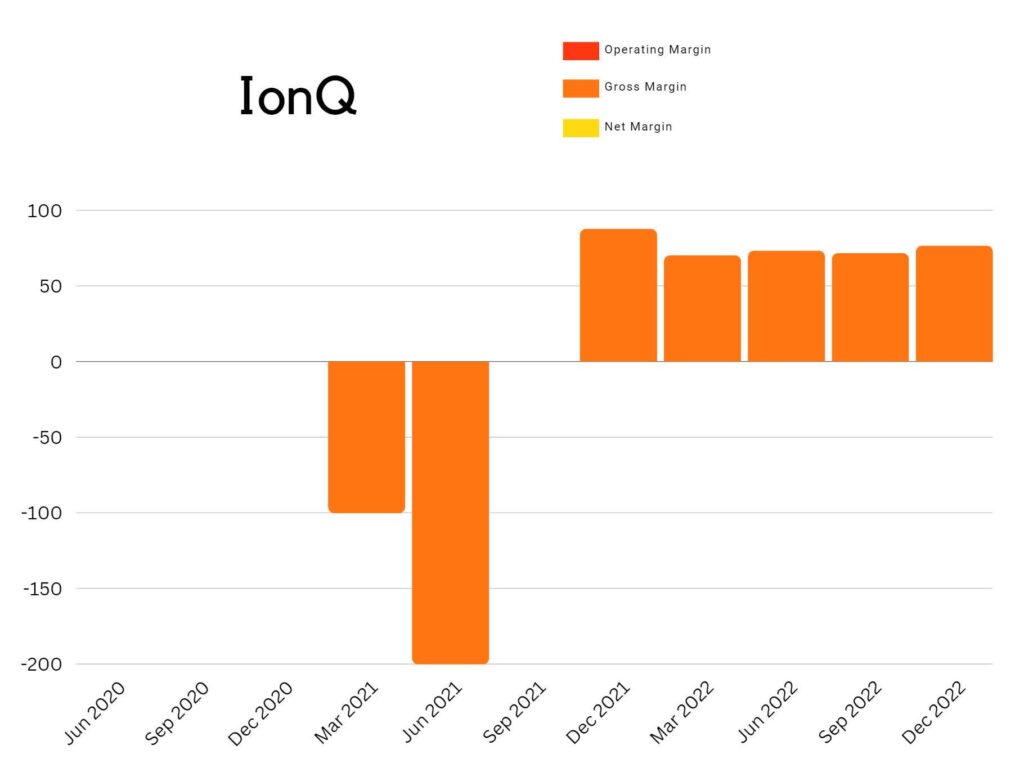

- Financial Performance: Investors will closely monitor IonQ’s financial statements, including revenue, expenses, and cash flow. Positive financial results and a clear path to profitability are essential for attracting and retaining investors.

- Management Team and Strategy: The leadership team’s vision, execution capabilities, and strategic decisions play a crucial role in the company’s success. A strong and experienced management team can inspire confidence and drive growth.

External Factors

- Market Sentiment: The overall sentiment towards quantum computing and emerging technologies can influence the demand for IonQ stock. Positive news and increased investor interest in the sector can drive up the stock price.

- Competition: IonQ faces competition from other quantum computing companies, such as IBM, Google, and Rigetti Computing. The competitive landscape can impact IonQ’s market share and pricing power.

- Regulatory Environment: Government regulations and policies related to quantum computing can affect the industry’s growth and development.

- Macroeconomic Conditions: Economic factors such as interest rates, inflation, and economic growth can influence investor sentiment and the overall stock market.

Analyzing IonQ’s Potential for Growth

To determine whether IonQ stock will go up, it’s essential to analyze the company’s potential for growth. This involves assessing its competitive advantages, market opportunities, and financial outlook.

Competitive Advantages

IonQ’s trapped-ion technology offers several potential advantages over competing approaches. These include:

- High Qubit Fidelity: Trapped ions are known for their high qubit fidelity, which means that the quantum information is less likely to be corrupted by noise.

- Long Coherence Times: Trapped ions can maintain their quantum states for relatively long periods, allowing for more complex computations.

- Full Connectivity: IonQ’s architecture allows for full connectivity between qubits, meaning that any qubit can interact with any other qubit. This can simplify the design of quantum algorithms.

These advantages could give IonQ a competitive edge in the quantum computing market. The question of will IonQ stock go up may hinge on the sustained demonstration of these advantages.

Market Opportunities

The quantum computing market is expected to grow rapidly in the coming years. According to various market research reports, the global quantum computing market could reach tens of billions of dollars by the end of the decade. This growth will be driven by increasing demand from various industries, including:

- Drug Discovery: Quantum computers can accelerate the discovery of new drugs and therapies by simulating molecular interactions.

- Materials Science: Quantum computers can help design new materials with improved properties.

- Finance: Quantum computers can be used for portfolio optimization, risk management, and fraud detection.

- Artificial Intelligence: Quantum computers can accelerate the training of machine learning models.

IonQ is well-positioned to capitalize on these market opportunities. However, it will need to demonstrate its ability to deliver practical solutions to these industries. If IonQ can successfully penetrate these markets, the IonQ stock will go up.

Financial Outlook

IonQ’s financial outlook is a key factor in determining its stock price. Investors will be looking for evidence of revenue growth, improving margins, and a clear path to profitability. In recent years, IonQ has shown promising revenue growth, but it is still operating at a loss. The company needs to continue to scale its operations and reduce its costs to achieve profitability. Whether IonQ stock will go up depends on the company’s ability to manage its finances effectively and achieve its financial goals.

Risks and Challenges

Investing in IonQ stock involves several risks and challenges. These include:

- Technological Risk: Quantum computing is still a nascent technology, and there is no guarantee that it will deliver on its promise. There is also the risk that competing technologies could emerge and displace IonQ’s approach.

- Commercialization Risk: IonQ needs to demonstrate its ability to commercialize its technology and generate revenue. This involves securing contracts with businesses and government agencies, which can be a challenging process.

- Competition Risk: IonQ faces competition from other quantum computing companies, some of which have greater resources and more established relationships.

- Financial Risk: IonQ is currently operating at a loss and needs to raise additional capital to fund its growth. There is a risk that the company will not be able to raise sufficient capital or that it will dilute its existing shareholders.

Investors should be aware of these risks before investing in IonQ stock. The potential for IonQ stock to go up is real, but so are the challenges.

Expert Opinions and Analyst Ratings

Various analysts and experts have offered their opinions on IonQ stock. These opinions vary, with some analysts being bullish on the company’s prospects and others being more cautious. It’s important to note that analyst ratings are not always accurate and should not be the sole basis for investment decisions. However, they can provide valuable insights into the company’s potential and the market’s perception of its value.

Conclusion: Will IonQ Stock Go Up?

The question of whether IonQ stock will go up is complex and depends on a variety of factors. IonQ is a leading player in the exciting field of quantum computing, with a promising technology and significant market opportunities. However, investing in IonQ involves risks, including technological, commercialization, and financial risks. Investors should carefully consider these risks and conduct their own due diligence before investing in IonQ stock. The potential for IonQ stock to go up exists, but it is not guaranteed. The future performance of IonQ stock will depend on the company’s ability to execute its strategy, overcome its challenges, and capitalize on its opportunities.

Ultimately, whether IonQ stock will go up is a question that only time will answer. However, by understanding the company, its technology, and the market in which it operates, investors can make informed decisions about whether to invest in this promising, yet risky, stock. Remember to consult with a financial advisor before making any investment decisions. [See also: Quantum Computing Stocks to Watch] [See also: Investing in Emerging Technologies] [See also: The Future of Quantum Computing]